|

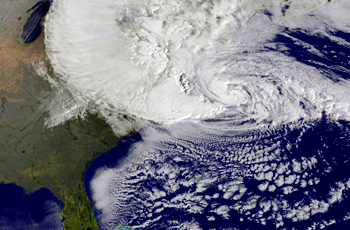

Though Hurricane Sandy barely touched Cape Cod last fall her influence on homeowners here is just beginning. Expanding flood zone maps and sharp increases in homeowner's insurance premiums promise to alter everything about owning a home on the Cape.

"We're just starting to see the new maps" says Charlie Bezanson of Roger's and Gray Insurance Agency in Orleans, Mass. "And they could have a huge impact on rates". Just as Hurricane Andrew spurred more stringent homebuilding codes and increases in homeowner's insurance rates in Florida 21 years ago, Hurricane Sandy will long be remembered as the wakeup call for the Northeastern U.S. The Superstorm caused $50 billion in damages. Sandy flooded portions of New York City, New Jersey and Connecticut and revealed both the hazards of densely populated seaside neighborhoods and weak spots of urban infrastructure. Boilers and generators in the basements of high-rise apartment and office buildings were flooded, knocking out power to hundreds of thousands of people. The wide swath of entire coastal communities which were entirely washed away might not be redeveloped, as forecasters say Superstorm Sandy is just the beginning of the extreme weather we'll experience with rising sea levels and a warming planet. Developers are heeding the alarm. In Boston, the waterfront district undergoing a renaissance will feature heating, cooling and ventilation systems on upper floors, according to Boston Redevelopment Authority chief planner Kairos Shen. But few places will have as broad an impact on residential homeownership as on Cape Cod, a low-lying 70 mile long sand bar stretching like a tight-fisted arm into the Atlantic ocean. The Federal Emergency Management Agency has redrawn the flood zones for every town and village on the Cape and every flood zone is larger than before. It's not just proximity to the sea. Inland neighborhoods that ring the thousands of acres of rivers and marshes here are also at new risk, as are homes that lie above a relatively high water table. Homeowners previously not required by their lenders to have flood insurance, will now be forced into the costly flood insurance pool. "We're hearing it's going to be bad", says Roger's and Gray's Bezanson. FEMA officials will appear at a series of town meetings in the coming weeks to explain how they arrived at the new zones and what homeowners need to do to prepare for rising sea levels and fiercer storms. The new zones take effect in June. Cape Cod real estate is already feeling the pinch. A check of the new zones on FEMA's flood zone map revealed a West Harwich home not formerly in a flood zone, is now partially located in the risky Zone A. Because the agent had included exclusion in the new flood zones as a contingency for the deal, the buyers changed their minds about purchasing that property. For this real estate agent, a check of the new FEMA flood map and a conversation with a Cape Cod insurance agent are part of the research conducted when assisting buyers and sellers. While buyers can continue their search for other properties, sellers may be disheartened to know their home may be less attractive to homeowners forced to pay more for insurance and less on the mortgage. To learn more about the new flood zones and the impact of rising seas, you can attend one of a series of public meetings, organized geographically. DENNIS When: Wednesday Time: 3 to 6:30 p.m. State and local experts make a presentation and take questions, until 8 p.m. Location: Dennis Senior Center, 1045 Route 134, South Dennis Towns included: Dennis, Brewster, Harwich, Chatham (maps for those towns will be available) EASTHAM When: Aug. 15 Time: 3 to 6 p.m. State and local experts present Location: Nauset Regional High School, 100 Cable Road, North Eastham Towns included: Provincetown, Chatham, Orleans, Eastham, Wellfleet, Truro CAPEWIDE When: Aug. 13 (Tentative. Check town websites for additional details) Time: TBA Location: TBA Likely mid-Cape area Towns included: Barnstable, Yarmouth, Mashpee, Bourne, Sandwich, and Falmouth

0 Comments

Leave a Reply. |

Maureen Green

|