|

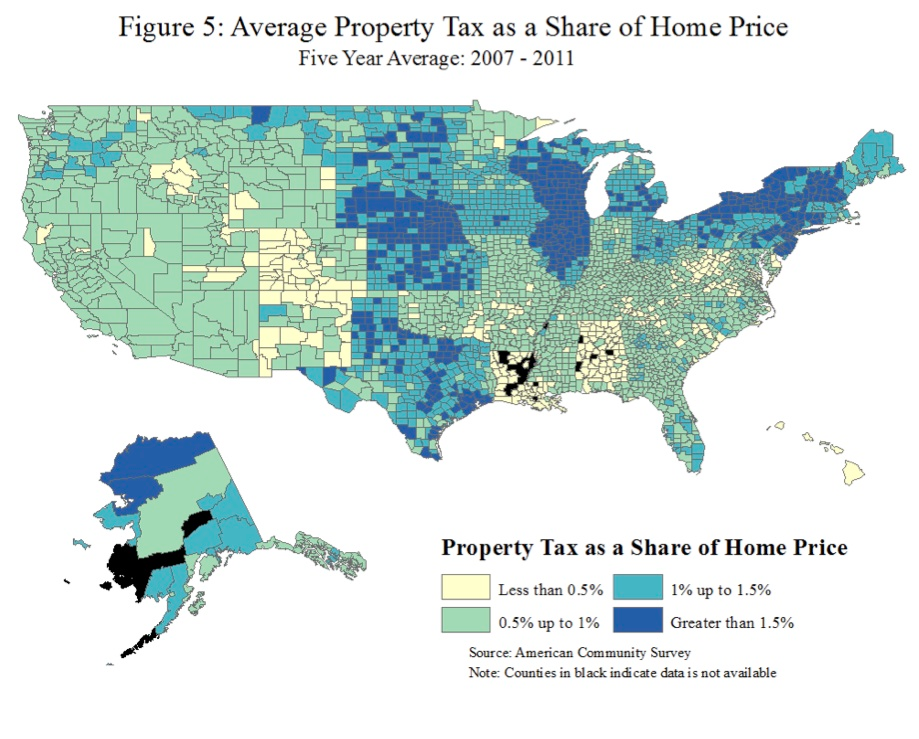

Cape Cod property owners pay the lowest taxes as a percentage of home value in Massachusetts, and among the lowest in the Northeast, according to a recent report by the Urban-Brookings Tax Policy Center. The authors of the study, Benjamin H. Harris and Brian David Moore, state that homeowners across the U.S. pay an average of $1,000 in property tax annually, which represents just under 1 percent of the value of their home. Massachusetts residents pay an average of 1 to 1.5 percent of the value of their home in annual property tax. Cape Codders pay .5 to 1 percent. Homeowners in New York and New Jersey pay in excess of 1.5 percent of the value of their home in county taxes each year.

For a home valued at $350,000, a property tax equal to .75 percent of the property on Cape Cod costs $2,625. per year. Compare that to the average Massachusetts property tax of 1.25 percent and the annual property tax bill on the same $350,000 home is $4,375, a difference of $1,750. That's a lot of lobster rolls. Maui County in Hawaii levies a tax of .2 percent of home value, while Wayne County in upstate New York, charges the highest in the U.S. at 3.1 percent. On a $350,000 home, the county tax bill in Maui is $700 annually, while in Wayne County the annual tax bill is $10,850. Authors Harris and Moore state that property taxes are highest in the Northeast and Midwest due largely to the high cost of real estate. Their findings concede that overall tax burden is complicated due to variances in within and across states. A free PDF copy of the report is available at the Urban-Brookings Tax Policy Center website. When you get there, search for the PDF icon to the right of the abstract.

0 Comments

Leave a Reply. |

Maureen Green

|