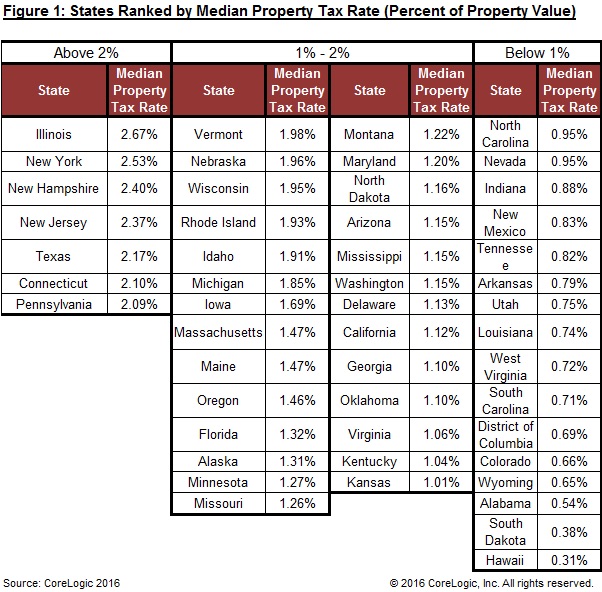

Massachusetts and Maine tie for the lowest property tax burden of the six New England states. That's according to the National Association of Realtors, using data from Core Logic. The report, titled "Comparing the Real Cost of Home Ownership Across the United States", calculates that the average property tax rate in the U.S. is 1.31 percent of value, but northeastern states have a higher rate with southern states generally requiring less. The highest rate in the country is the state of Illinois. There, homeowners pay 2.67 percent of the value of their homes in property tax each year, followed by New York State at 2.53. In New England, New Hampshire leads the pack at 2.43 percent, owing perhaps to the lack of a state sales tax there. Connecticut follows at 2.10, Vermont is next at 1.98. Rhode Island stands at 1.93. Massachusetts and Maine tie at 1.47 percent. Where does your state rank? Consult the table below, provided by Core Logic.

1 Comment

|

Maureen Green

|